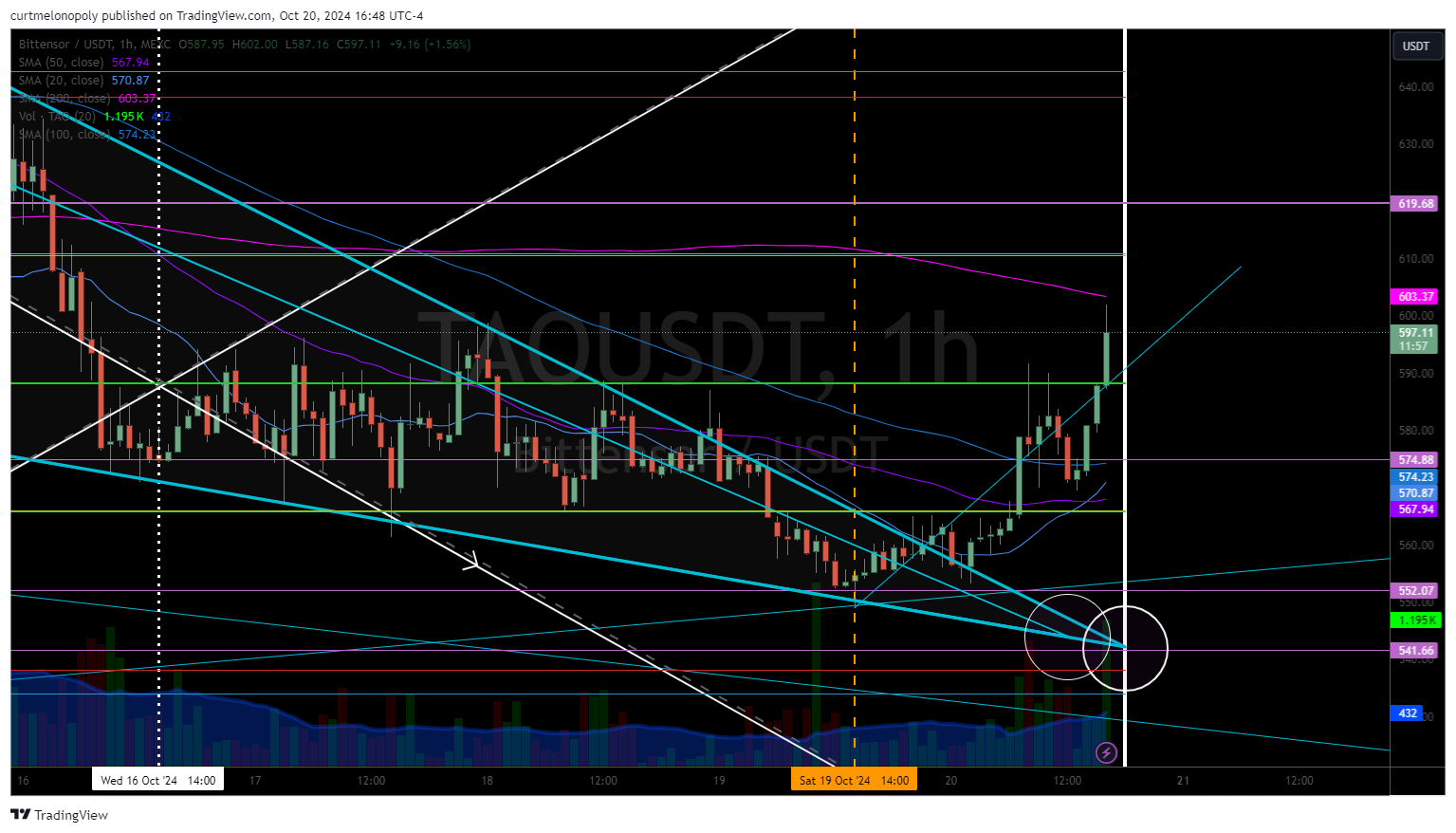

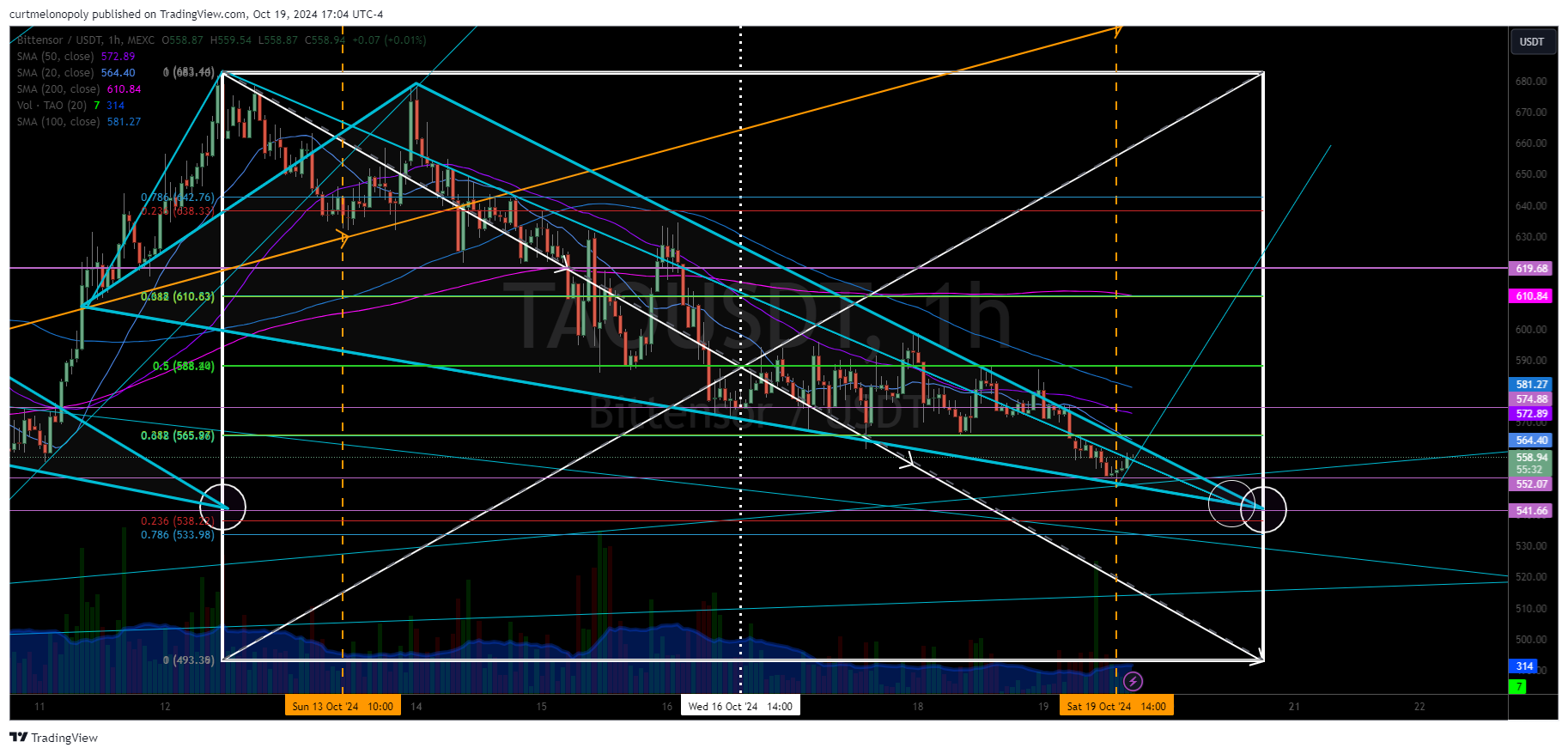

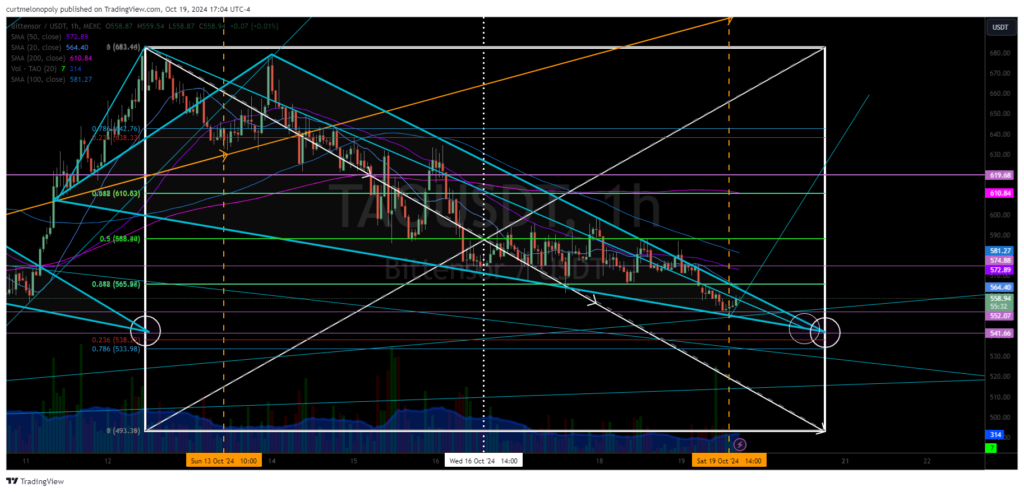

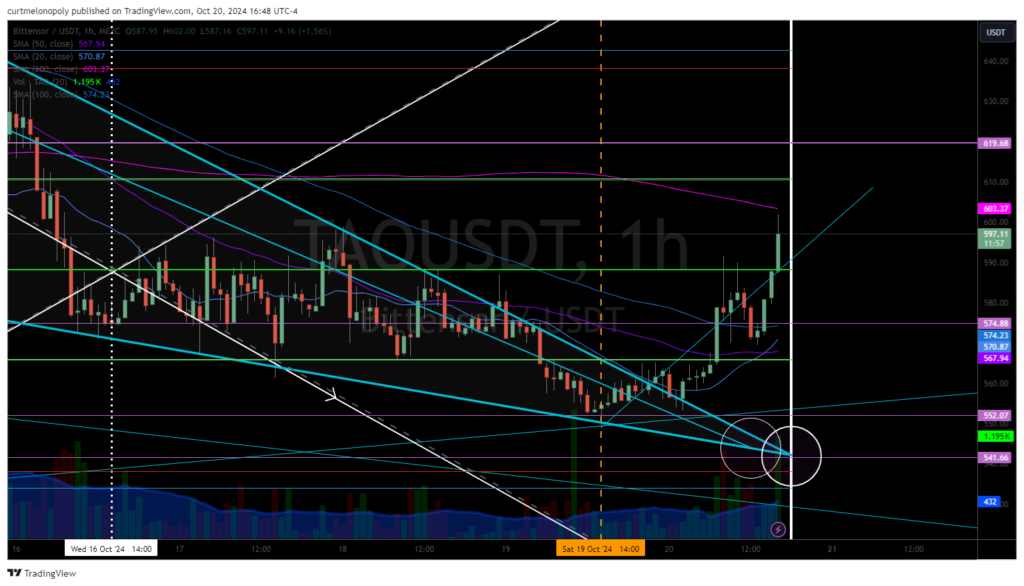

Bittsensor (TAO) gets a serious bounce out of falling wedge and in to timing. Very nice structure setting up for this week.

The Most Exclusive & Sophisticated Ape Club in Crypto

Trade Signal Chat Rooms with Option to Deploy World Class Machine Learning Automated Trade to Your Account(s).

Telegram: For a Free Trial contact @cogdok